Main Article Content

Abstract

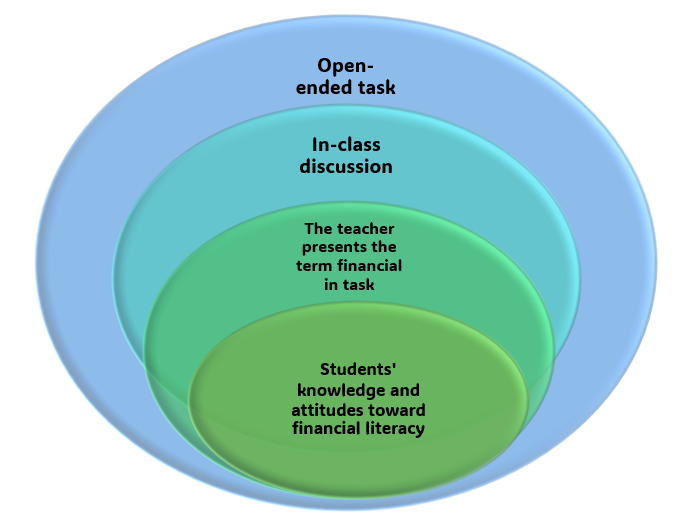

This study explores how junior high school students understand different types of discounts through percent multiplication. We used the qualitative study and analyzed the in-depth answers of three of the 32 participants as research subjects. The end-of-year discount selection activity provides a daily context to build knowledge about needs and wants. Students engage with open-ended tasks requiring mathematical methods to make financial decisions. These activities help students recognize discounts in everyday life, develop problem-solving strategies, and improve mathematical skills. The article highlights how students analyze various store discounts and guide readers in distinguishing between needs and wants. Early exposure to financial math fosters responsible consumer behavior. The study emphasizes the importance of applying comprehensive information to solve financial problems by connecting mathematics to real-life scenarios. The results indicate that the implementation of an open-ended task has the potential to facilitate understanding of financial decision-making and mathematical skills.

Keywords

Article Details

Copyright (c) 2025 Laela Sagita, Ratu Ilma Indra Putri, Zulkardi, Rully Charitas Indra Prahmana

This work is licensed under a Creative Commons Attribution 4.0 International License.

This journal provides immediate open access to its content on the principle that making research freely available to the public supports a greater global exchange of knowledge.

All articles published Open Access will be immediately and permanently free for everyone to read and download. We are continuously working with our author communities to select the best choice of license options, Creative Commons Attribution-ShareAlike (CC BY-NC-SA).

References

- Cavalcante, A., & Savard, A. (2021). Making sense of mathematics: Two case studies of financial numeracy in grade 11 mathematics classrooms. Financial Numeracy in Mathematics Education: Research and Practice, 81-92. https://doi.org/10.1007/978-3-030-73588-3_9

- Creswell, J. W. (2013). Qualitative inquiry and research design: Choosing among five approaches (3rd ed.). SAGE Publications. https://revistapsicologia.org/public/formato/cuali2.pdf

- Dituri, P., Davidson, A., & Marley-Payne, J. (2019). Combining financial education with mathematics coursework: Findings from a pilot study. Journal of Financial Counseling and Planning, 30(2), 313–322. https://doi.org/10.1891/1052-3073.30.2.313

- Etikan, I. (2016). Comparison of convenience sampling and purposive sampling. American Journal of Theoretical and Applied Statistics, 5(1), 1-4. https://doi.org/10.11648/j.ajtas.20160501.11

- Gravemeijer, K., & van Eerde, D. (2009). Design research as a means for building a knowledge base for teachers and teaching in mathematics education. The Elementary School Journal, 109(5), 510-524. https://www.journals.uchicago.edu/doi/abs/10.1086/596999

- Gong, H., Huang, J., & Goh, K. H. (2019). The illusion of double‐discount: Using reference points in promotion framing. Journal of Consumer Psychology, 29(3), 483–491. https://doi.org/10.1002/jcpy.1102

- Gordon-Hecker, T., Pittarello, A., Shalvi, S., & Roskes, M. (2020). Buy-one-get-one-free deals attract more attention than percentage deals. Journal of Business Research, 111, 128-134. https://doi.org/10.1016/j.jbusres.2019.02.070

- Kosyvas, G. (2016). Levels of arithmetic reasoning in solving an open-ended problem. International Journal of Mathematical Education in Science and Technology, 47(3), 356–372. https://doi.org/10.1080/0020739X.2015.1072880

- Lamb, J., & Booker, G. (2004). The impact of developing teacher conceptual knowledge on students’ knowledge of division. Proceedings of the 28th International Group for the Psychology of Mathematics Education Conference, 177–182. https://files.eric.ed.gov/fulltext/ED489545.pdf

- Lusardi, A. (2019). Financial literacy and the need for financial education: evidence and implications. Swiss Journal of Economics and Statistics, 155(1), 1-8. https://doi.org/10.1186/s41937-019-0027-5

- Lusardi, A., & Mitchell, O. S. (2014). The economic importance of financial literacy: Theory and evidence. American Economic Journal: Journal of Economic Literature, 52(1), 5-44. https://10.1257/jel.52.1.5

- Lusardi, A., & Mitchell, O. S. (2023). The importance of financial literacy: Opening a new field. Journal of Economic Perspectives, 37(4), 137-154. https://10.1257/jep.37.4.137

- Miles, M. B., & Huberman, A. M. (2014). Qualitative data analysis: A methods sourcebook (3rd ed.). SAGE Publications.

- Moreira Costa, V., De Sá Teixeira, N. A., Cordeiro Santos, A., & Santos, E. (2021). When more is less in financial decision-making: Financial literacy magnifies framing effects. Psychological Research, 85(5), 2036-2046. https://doi.org/10.1007/s00426-020-01372-7

- Nieminen, J. H., Chan, M. C. E., & Clarke, D. (2022). What affordances do open-ended real-life tasks offer for sharing student agency in collaborative problem-solving?. Educational Studies in Mathematics, 109(1), 115-136. https://doi.org/10.1007/s10649-021-10074-9

- Nusantara, T., & Susanto, H. (2016). The students decision making in solving discount problem. International Education Studies, 9(7), 57-63. https://10.5539/ies.v9n7p57

- OECD (2019). PISA 2018 Assessment and Analytical Framework. https://www.oecd-ilibrary.org/docserver/b25efab8-en.pdf?expires=1718694908&id=id&accname=guest&checksum=4583C94C0725F7B78807D944A5020591

- OECD (2024). PISA 2022 Results (Volume IV): How Financially Smart Are Students?, PISA, OECD Publishing, Paris, https://doi.org/10.1787/5a849c2a-en.

- Prayitno, S. B. (2023). Analysis of the perception of free shipping promotions on purchasing decisions on the shopee marketplace. Journal of Management Science (JMAS), 6(2), 199-205. https://doi.org/10.35335/jmas.v6i2.230

- Sagita, L., Putri, R. I. I., Zulkardi, & Prahmana, R. C. I. (2023a). Promising research studies between mathematics literacy and financial literacy through project-based learning. Journal on Mathematics Education, 13(4), 753–772. https://doi.org/10.22342/jme.v13i4.pp753-772

- Sagita, L., Putri, R. I. I., Zulkardi, Z., & Prahmana, R. C. I. (2023b). Basic arithmetic on financial literacy skills: A new learning outcome. JRAMathEdu (Journal of Research and Advances in Mathematics Education), 8(1). https://doi.org/10.23917/jramathedu.v8i1.1252

- Sawatzki, C. (2017). Lessons in financial literacy task design: Authentic, imaginable, useful. Mathematics Education Research Journal, 29(1), 25-43. https://doi.org/10.1007/s13394-016-0184-0

- Sawatzki, C., Zmood, S., & Davidson, A. (2020). Using financial modelling to decide" Should I tap into my superannuation?". Australian Mathematics Education Journal, 2(2), 22-27. https://search.informit.org/doi/abs/10.3316/INFORMIT.287245903542863

- Sawatzki, C., & Goos, M. (2018). Cost, price and profit: what influences students’ decisions about fundraising?. Mathematics Education Research Journal, 30(4), 525-544. https://doi.org/10.1007/s13394-018-0241-y

- Sawatzki, C., & Sullivan, P. (2018). Shopping for shoes: Teaching students to apply and interpret mathematics in the real world. International Journal of Science and Mathematics Education, 16, 1355-1373. https://doi.org/10.1007/s10763-017-9833-3

- Savard, A. (2022a). Navigating in a Complex World Using Mathematics: The Role Played by Financial Numeracy. In: Michelsen, C., Beckmann, A., Freiman, V., Jankvist, U.T., Savard, A. (Eds) Mathematics and Its Connections to the Arts and Sciences (MACAS). Mathematics Education in the Digital Era, vol 19. Springer, Cham. https://doi.org/10.1007/978-3-031-10518-0_14

- Savard, A. (2022b). What did they have to say about money and finance? Grade 4 students’ representations about financial concepts when learning mathematics. Education 3-13, 50(3), 316–328. https://doi.org/10.1080/03004279.2020.1850826

- Savard, A., & Polotskaia, E. (2017). Who’s wrong? Tasks fostering understanding of mathematical relationships in word problems in elementary students. ZDM, 49(6), 823–833. https://doi.org/10.1007/s11858-017-0865-5

- Setianingsih, R., Sa’dijah, C., As’ari, A. R., & Muksar, M. (2017). Investigating fifth-grade students’ construction of mathematical knowledge through classroom discussion. International Electronic Journal of Mathematics Education, 12(3), 383–396. https://doi.org/10.29333/iejme/619

- Thomas, P., & Chrystal, A. (2013). Explaining the “buy one get one free” promotion: the golden ratio as a marketing tool. American Journal of Industrial and Business Management, 3(08), 655-673. https://10.4236/ajibm.2013.38075

- Van den Heuvel-Panhuizen, M., Drijvers, P. (2020). Realistic Mathematics Education. In: Lerman, S. (Eds), Encyclopedia of Mathematics Education. Springer, Cham. https://doi.org/10.1007/978-3-030-15789-0_170

References

Cavalcante, A., & Savard, A. (2021). Making sense of mathematics: Two case studies of financial numeracy in grade 11 mathematics classrooms. Financial Numeracy in Mathematics Education: Research and Practice, 81-92. https://doi.org/10.1007/978-3-030-73588-3_9

Creswell, J. W. (2013). Qualitative inquiry and research design: Choosing among five approaches (3rd ed.). SAGE Publications. https://revistapsicologia.org/public/formato/cuali2.pdf

Dituri, P., Davidson, A., & Marley-Payne, J. (2019). Combining financial education with mathematics coursework: Findings from a pilot study. Journal of Financial Counseling and Planning, 30(2), 313–322. https://doi.org/10.1891/1052-3073.30.2.313

Etikan, I. (2016). Comparison of convenience sampling and purposive sampling. American Journal of Theoretical and Applied Statistics, 5(1), 1-4. https://doi.org/10.11648/j.ajtas.20160501.11

Gravemeijer, K., & van Eerde, D. (2009). Design research as a means for building a knowledge base for teachers and teaching in mathematics education. The Elementary School Journal, 109(5), 510-524. https://www.journals.uchicago.edu/doi/abs/10.1086/596999

Gong, H., Huang, J., & Goh, K. H. (2019). The illusion of double‐discount: Using reference points in promotion framing. Journal of Consumer Psychology, 29(3), 483–491. https://doi.org/10.1002/jcpy.1102

Gordon-Hecker, T., Pittarello, A., Shalvi, S., & Roskes, M. (2020). Buy-one-get-one-free deals attract more attention than percentage deals. Journal of Business Research, 111, 128-134. https://doi.org/10.1016/j.jbusres.2019.02.070

Kosyvas, G. (2016). Levels of arithmetic reasoning in solving an open-ended problem. International Journal of Mathematical Education in Science and Technology, 47(3), 356–372. https://doi.org/10.1080/0020739X.2015.1072880

Lamb, J., & Booker, G. (2004). The impact of developing teacher conceptual knowledge on students’ knowledge of division. Proceedings of the 28th International Group for the Psychology of Mathematics Education Conference, 177–182. https://files.eric.ed.gov/fulltext/ED489545.pdf

Lusardi, A. (2019). Financial literacy and the need for financial education: evidence and implications. Swiss Journal of Economics and Statistics, 155(1), 1-8. https://doi.org/10.1186/s41937-019-0027-5

Lusardi, A., & Mitchell, O. S. (2014). The economic importance of financial literacy: Theory and evidence. American Economic Journal: Journal of Economic Literature, 52(1), 5-44. https://10.1257/jel.52.1.5

Lusardi, A., & Mitchell, O. S. (2023). The importance of financial literacy: Opening a new field. Journal of Economic Perspectives, 37(4), 137-154. https://10.1257/jep.37.4.137

Miles, M. B., & Huberman, A. M. (2014). Qualitative data analysis: A methods sourcebook (3rd ed.). SAGE Publications.

Moreira Costa, V., De Sá Teixeira, N. A., Cordeiro Santos, A., & Santos, E. (2021). When more is less in financial decision-making: Financial literacy magnifies framing effects. Psychological Research, 85(5), 2036-2046. https://doi.org/10.1007/s00426-020-01372-7

Nieminen, J. H., Chan, M. C. E., & Clarke, D. (2022). What affordances do open-ended real-life tasks offer for sharing student agency in collaborative problem-solving?. Educational Studies in Mathematics, 109(1), 115-136. https://doi.org/10.1007/s10649-021-10074-9

Nusantara, T., & Susanto, H. (2016). The students decision making in solving discount problem. International Education Studies, 9(7), 57-63. https://10.5539/ies.v9n7p57

OECD (2019). PISA 2018 Assessment and Analytical Framework. https://www.oecd-ilibrary.org/docserver/b25efab8-en.pdf?expires=1718694908&id=id&accname=guest&checksum=4583C94C0725F7B78807D944A5020591

OECD (2024). PISA 2022 Results (Volume IV): How Financially Smart Are Students?, PISA, OECD Publishing, Paris, https://doi.org/10.1787/5a849c2a-en.

Prayitno, S. B. (2023). Analysis of the perception of free shipping promotions on purchasing decisions on the shopee marketplace. Journal of Management Science (JMAS), 6(2), 199-205. https://doi.org/10.35335/jmas.v6i2.230

Sagita, L., Putri, R. I. I., Zulkardi, & Prahmana, R. C. I. (2023a). Promising research studies between mathematics literacy and financial literacy through project-based learning. Journal on Mathematics Education, 13(4), 753–772. https://doi.org/10.22342/jme.v13i4.pp753-772

Sagita, L., Putri, R. I. I., Zulkardi, Z., & Prahmana, R. C. I. (2023b). Basic arithmetic on financial literacy skills: A new learning outcome. JRAMathEdu (Journal of Research and Advances in Mathematics Education), 8(1). https://doi.org/10.23917/jramathedu.v8i1.1252

Sawatzki, C. (2017). Lessons in financial literacy task design: Authentic, imaginable, useful. Mathematics Education Research Journal, 29(1), 25-43. https://doi.org/10.1007/s13394-016-0184-0

Sawatzki, C., Zmood, S., & Davidson, A. (2020). Using financial modelling to decide" Should I tap into my superannuation?". Australian Mathematics Education Journal, 2(2), 22-27. https://search.informit.org/doi/abs/10.3316/INFORMIT.287245903542863

Sawatzki, C., & Goos, M. (2018). Cost, price and profit: what influences students’ decisions about fundraising?. Mathematics Education Research Journal, 30(4), 525-544. https://doi.org/10.1007/s13394-018-0241-y

Sawatzki, C., & Sullivan, P. (2018). Shopping for shoes: Teaching students to apply and interpret mathematics in the real world. International Journal of Science and Mathematics Education, 16, 1355-1373. https://doi.org/10.1007/s10763-017-9833-3

Savard, A. (2022a). Navigating in a Complex World Using Mathematics: The Role Played by Financial Numeracy. In: Michelsen, C., Beckmann, A., Freiman, V., Jankvist, U.T., Savard, A. (Eds) Mathematics and Its Connections to the Arts and Sciences (MACAS). Mathematics Education in the Digital Era, vol 19. Springer, Cham. https://doi.org/10.1007/978-3-031-10518-0_14

Savard, A. (2022b). What did they have to say about money and finance? Grade 4 students’ representations about financial concepts when learning mathematics. Education 3-13, 50(3), 316–328. https://doi.org/10.1080/03004279.2020.1850826

Savard, A., & Polotskaia, E. (2017). Who’s wrong? Tasks fostering understanding of mathematical relationships in word problems in elementary students. ZDM, 49(6), 823–833. https://doi.org/10.1007/s11858-017-0865-5

Setianingsih, R., Sa’dijah, C., As’ari, A. R., & Muksar, M. (2017). Investigating fifth-grade students’ construction of mathematical knowledge through classroom discussion. International Electronic Journal of Mathematics Education, 12(3), 383–396. https://doi.org/10.29333/iejme/619

Thomas, P., & Chrystal, A. (2013). Explaining the “buy one get one free” promotion: the golden ratio as a marketing tool. American Journal of Industrial and Business Management, 3(08), 655-673. https://10.4236/ajibm.2013.38075

Van den Heuvel-Panhuizen, M., Drijvers, P. (2020). Realistic Mathematics Education. In: Lerman, S. (Eds), Encyclopedia of Mathematics Education. Springer, Cham. https://doi.org/10.1007/978-3-030-15789-0_170